Streamline AML compliance with an all-in-one solution for automated identity verification and risk screening.

Get Started Now

LOWEST PRICE GUARANTEED

OVER 10 MILLION IDENTITIES VERIFIED AND COUNTING

KYC, AML, GDPR, AND PCI LEVEL 1 COMPLIANT

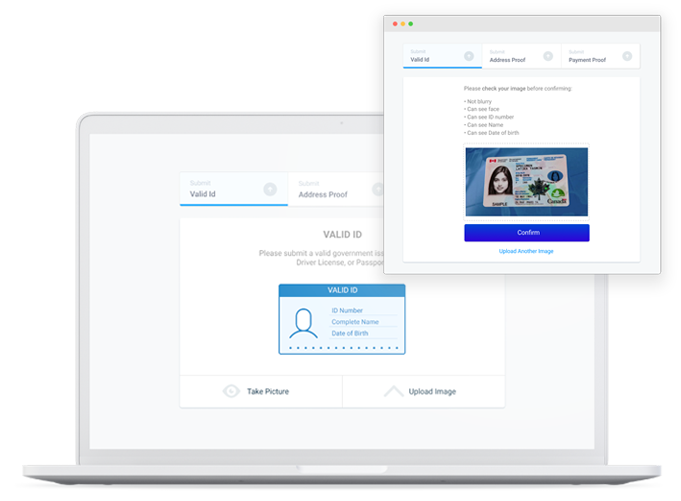

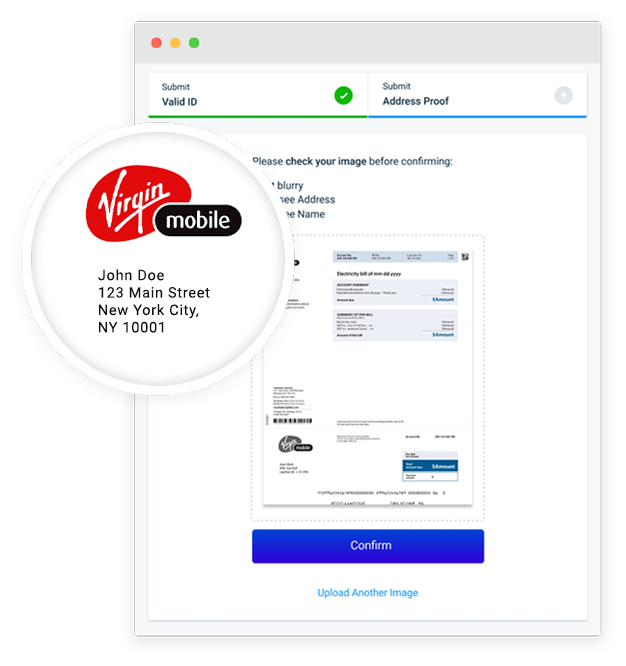

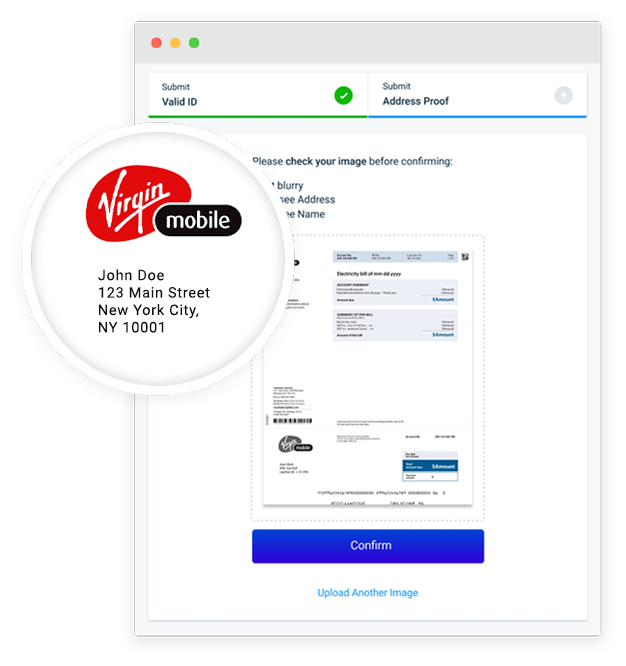

User is asked to scan and upload their ID documents.

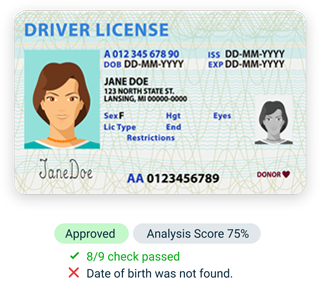

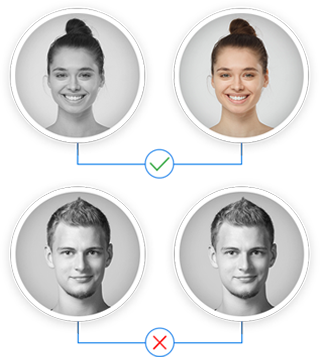

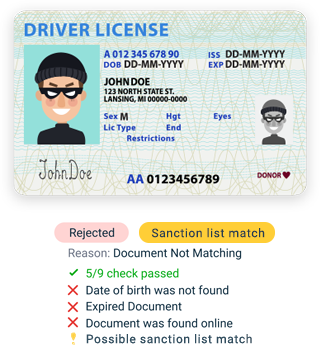

The documents are authenticated by powerful AI technology.

If unsure, your compliance team has the option to manually accept or reject documents.

Ongoing risk monitoring of user’s information against Sanctions and PEPs lists.

Our user-friendly KYC process can be seamlessly integrated into your existing flow. This means quicker and smoother onboarding for your customers.

Our secure transaction and verification features will protect your business against identity fraud, compliance failure, and account takeovers. To fully protect your data, we offer easy on-premise deployment to your own data center or direct RESTful API integration.

Comply Services reduces labor costs and saves time by utilizing automated verification processes that reduce false positives and validate your customer's legitimacy without the need of time-sapping manual ID checks.

Our software takes care of all your compliance issues bringing you up to code with the latest AML (Anti Money Laundering), KYC (Know Your Customer), and GDPR (General Data Protection Regulation) obligations.

Capture the front and back of official ID documents, extract data automatically, and determine instantly if it’s real and belongs to the user.

Enables your users to quickly scan documents such as utility bills, credit card statements, and bank statements.

Make the right AML risk decisions with global coverage of sanctions, watchlists, and Politically Exposed Persons (PEPs) data.

Insurance

Payment

Lending

Banking

Gambling & Gaming

High-Risk Corporation

Investment

Crypto